Crypto Art. Who’s Here? What’s Happening?

Crypto Art. Who’s Here? What’s Happening?

Aiming to study the phenomenon of crypto art in relation to traditional art categories and economic value creation and distribution, on June 15th, 2021, our team released the first large-scale survey on the subject, for the whole crypto community to take part in. Over the past months, the survey was taken by nearly two-hundred people, about half of which replied to all questions. According to one of the earliest NFT market data resources, mapping the space since 2018 and currently monitoring over 30 major crypto art projects and platforms, the number of unique wallets that bought and sold at least one crypto artwork over these years is 7,025. This mapping might not be comprehensive and there is no way to isolate the exact number of people behind active wallets, as each user can hold multiple ones, but it can help put into perspective the number of participants in our survey. Despite the limited size of the sample and the short time frame of this study, conducted last summer, it does certainly provide a benchmark for future investigations. So, let’s look at some results.

In the current analysis, we concentrated on socio-demographics and users’ general approach to crypto art. According to the participants’ replies, the following key facts emerge:

- most users are in their thirties and forties, come from the United States or Europe, and have experience in the creative and technological fields;

- the gender inequity in the crypto community is similar to that of the traditional art market in terms of representation of female artists by dealers, stable at 37% in 2020 according to the Art Basel and UBS Art Market Report 2021;

- most participants outlined goals such as collaborative attitudes, direct communication, and the idea of sharing, mainly considering artworks as something worth publicly showcasing and preserving over time;

- crypto art is generally deemed economically profitable and innovative, in particular regarding royalties, as artists keep earning a percentage from the secondary sales of their works.

Here follows a more extended overview on the crypto art community and the opportunities and challenges crypto art represents for its users.

So, Who’s Here? / Demographics and Background

Considering age ranges, most survey participants involved in crypto art were born between 1977 and 1990. The eldest was born in 1960 while the youngest in 2007, so it appears that crypto art mostly appeals to people in their thirties and forties but can interest very different age segment, teenagers included. Aligning with current traditional art market trends, male participants almost double female ones (60% vs about 34%), according to the 100 replies collected for this question. The most represented countries are the United States, Italy, and the United Kingdom, a result that does not surprise given that most of the major crypto art galleries and marketplaces are based in the US. A notable exception is KnownOrigin, which was inaugurated in April 2018 in Manchester just a few days after SuperRare, based in New York. The strong Italian presence registered might reflect more the participation in the survey rather than the actual composition of the community. However, it is worth mentioning that early adoption of crypto art by prominent artists from north-eastern Italy might have helped this genre’s diffusion in the peninsula too.

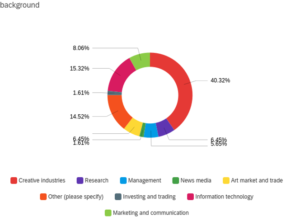

Regarding employment and professional background, the keyword is variety. According to the 99 replies collected, users are mostly self-employed (nearly 60%) or working as employees (36%), and usually come from creative industries (40%), Information Technology (15%) or marketing and communication (8%). About 6% are involved in art market and trade, research, or management, and although 14% of the total decided to specify their background, most replies were still tied to creative industries and tech, which can be confirmed as leading background sectors.

Crypto art users’ typical average net worth hovers between $10,001 to $50,000 (22% of the 99 replies) and $100,001 to $500,000 (24%). However, a significant percentage of participants falls also in the $50,001 to $100,000 option (18%). Such results show how crypto art appeals to people with very different economic situations, indicating that the access to the space is not directly tied to income. Regarding the cryptocurrencies accounting for at least 20% of their crypto holdings, Ether leads with over 45% positive replies, followed by Bitcoin, held by 23% of the 165 people who replied, and Tezos, chosen by about 15%. Given that most crypto art platforms, including the earliest and major ones, are built on Ethereum, with Bitcoin being the first and most widely adopted blockchain, what might surprise is the high performance of Tezos.

But let’s plunge deeper into the crypto art sphere and look at users’ direct involvement in it.

The Perks of Joining / Involvement and Returns

According to the most significant percentages, it seems that the crypto art movement took momentum in (late) 2020 with a peak in early 2021, as about 30% of people were involved since early 2021; 22% joined the community in late 2020 while 20% were already part of it since 2018 or before. This might suggest that crypto art provided users with a digital environment accessible despite the restrictions caused by the pandemic. The sale of Beeple’s crypto artwork EVERYDAYS: THE FIRST 5000 DAYS for USD 69,346,250 that took place on March 11 might have helped NFTs catch the mass’s attention with its resonance, perhaps contributing to the increase of interest in the phenomenon in early 2021 as well.

When asked why they got involved in crypto art, about 80% of the 130 survey participants who replied to this question affirmed that they wished to explore a new trend, while about 70% (strongly) agreed with the idea of entering the space to either sell art, connect and collaborate with fellow artists or make a profit. It is interesting that not everyone involved wishes to profit from what was essentially born as an art market. These results indicate that some people started engaging with the crypto art world to enjoy a variety of aspects beyond economic benefits, and are interested in social or aesthetic aspects. In particular, collaborative attitudes and the idea of sharing seem to be recurring traits in the crypto community, as some of the following results will clarify.

Of the people who replied, 40% did not approach crypto art to secure the value of their crypto investments through digital artworks and 30% are neutral on the matter. At the same time, up to 64% wished to experiment with token economics. This might suggest that including NFTs in an investment strategy was under the users’ radar when they first joined the domain, but it later became an option at least for some of them. Regardless, curiosity and novelty remain great drivers.

Of the people who replied, 40% did not approach crypto art to secure the value of their crypto investments through digital artworks and 30% are neutral on the matter. At the same time, up to 64% wished to experiment with token economics. This might suggest that including NFTs in an investment strategy was under the users’ radar when they first joined the domain, but it later became an option at least for some of them. Regardless, curiosity and novelty remain great drivers.

Whether to find a source of income was among users’ initial goals or not, crypto art seems synonymous with profitability. Of the 130 people who replied, 60% perceive that their economic situation has slightly improved or did not change significantly, while up to 25% noticed a great improvement. A mere 5% feel that their situation has somewhat worsened and 10% are still not interested in profit. Notably, nobody finds their economic situation severely worse due to crypto art so far. Of this sample, nearly 80% are active as artists and devote to crypto art the amount of time usually allocated to a full- or part-time job (25% makes art for 40h weekly and another 25% for 20h weekly), signaling how this occupation is not just a hobby. Interestingly, 85% are also active as collectors, of which 41% spend less than 3 hours weekly collecting art and 37% up to 10 hours. Apparently, whoever makes crypto art is usually an avid collector of it too.

So, What’s Happening? / Crypto Art Use

The crypto art community appears as a very diverse environment, composed of people with a variety of cultural and professional backgrounds and economic resources who create or collect crypto art. But what do these people do with it?

Over 80% of the 129 people who replied to this question agree or strongly agree on holding and exhibiting their art online, with about 75% doing it also in digital worlds and only 40% in the physical one. About 70% use crypto artworks as profile images or sell them. Over 55% gift their art and 25% show neutrality on the matter. Combining these results with those of another survey question on restrictions in crypto art, we find out that unrestrained use remains appealing to crypto art users, as 40% wish crypto art to remain unrestricted in the future while 41% think – and perhaps fears – some regulations might appear with time. Interestingly, less than 20% want such restrictions to be applied.

Looking back into crypto art use, the vast majority seems to perceive crypto artworks as something worth preserving over time (with just 7% against) and showcasing, promoting the idea of sharing them in “public” spaces online or gifting them.

How to Stay in the Loop? / Information Sources

When asked to indicate the three most influential people in the space, many participants stated that they would not think of anyone in particular, showing how the idea of “influencer” is generally badly perceived by the community. Still, besides null and negative replies, a few people emerged. So far, the most voted profiles were those of: artist and curator Jason Bailey, with his blog Artnome, VerticalCrypto Art, a media hub and NFT studio, artist Mario Klingenmann (@Quasimondo) and collectors Pransky and DigitalArtChick.

Twitter and Discord are listed as the main information sources for the crypto community, along with Telegram, Instagram and Clubhouse and generic crypto art gallery editorials, newsletters, or blogs. Apparently, networking and interaction with the community is key to stay informed, with users privileging direct messages or tweets.

According to most replies, what seems to be missing to stay informed and communicate in the community is mostly time. Most users also lament the lack of a reliable aggregator of (market) data, news, and cultural discourse on crypto art. The impression we gathered from most replies is that the ecosystem is extremely vast and fast, with users feeling the need for a discovery tool. According to many, a (de)centralized, transparent, possibly cross-blockchain and calendar-like media source would truly help them collect and process all the information on what is happening or what is about to happen in the dazzling crypto domain.

Crypto Art Pros and Cons / Opportunities and Challenges

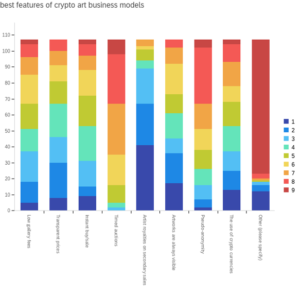

We then asked users to focus on what is already at their disposal and, in particular, on some new features of crypto art business models. Here is a selection of the most important ones according to the 101 survey participants who ranked them from 1 (the most important) to 9 (the least important), as shown in the graph:

– “Artist royalties on secondary sales” ranks 1st for 40%, 2nd for 25% and 3rd for 20%, definitely deserving the podium;

– “Artworks are always visible” ranks 1st for 16% but if we take into account also 2nd and 3rd position it weighs almost as “Price transparency”;

– “The use of crypto currencies” ranks 1st for 10% but if we take into account also 2nd and 3rd position it weighs almost as “Low gallery fees” and “Instant buy/sale”

– “Timed auctions”, deemed the least interesting feature by 30%, and “Pseudo-anonymity” are perceived as less important in comparison to other options.

Apparently, the possibility for artists to keep benefitting from their work’s resale is perceived as the most important novelty enabled by crypto art. In fact, it was a group of artists that managed to obtain the standard of 10% royalties on the secondary market across all the main platforms. Transparency and the ability to keep works visible to all are also highly valued by users. It is interesting to see how these features, tied to the idea of directness and open fruition, weigh more than secondary economic aspects, such as low gallery fees or instant buy/sale.

Regarding the opportunities represented by crypto art in general, the 98 people who replied mostly agreed with the suggested selection. The most strongly perceived opportunity is the development and use of creative digital technologies, paired with artist royalties on re-sales (both about 95%). Again, we see how crypto art’s innovative character and the possibility for artists and creatives to keep profiting from their works over time are crucial to the community. In second position, we find the use of blockchain technology and the development of a counter/subculture movement (about 90%); strongly valued are also diversity and inclusivity of crypto art, together with transactions’ immediacy (about 87%).

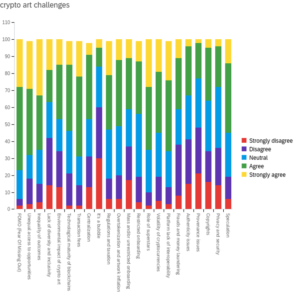

Considering the same people’s (strong) agreement with the proposed options, when it comes to crypto art challenges, the Fear of Missing Out (FOMO) leads the way with 77%; somewhat all in second position we find: transaction fees (68%); unequal access to opportunities and role of superstars (both 67%); inequality of outcomes (66%) and platform lack of interoperability (65%). The third place goes to technological maturity of blockchains, speculation and volatility of cryptocurrencies (about 54%), together with regulations and taxation and overtokenization and artwork inflation (about 52%). This shows that despite its initial accessibility, the crypto environment actually presents some economic, technical and perhaps social limits. In particular, it seems that factors like unequal visibility and hype are particularly felt by the community. What worries users the least is the risk of crypto art being a bubble, as about 61% do not feel this as an actual challenge.